Interest in Income: Unlocking the Secrets of Fixed Income Yields

Stability and predictable returns are hallmarks of conservative investment portfolios, which often rely on investments. These types of investments encompass bonds, treasury securities, and various financial instruments that deliver returns on a fixed schedule.

The primary allure of fixed income investments is their capability to provide steady income streams. This characteristic particularly appeals to retirees and investors who prefer to minimise risk, as it allows for more reliable financial planning and security in their investment returns.

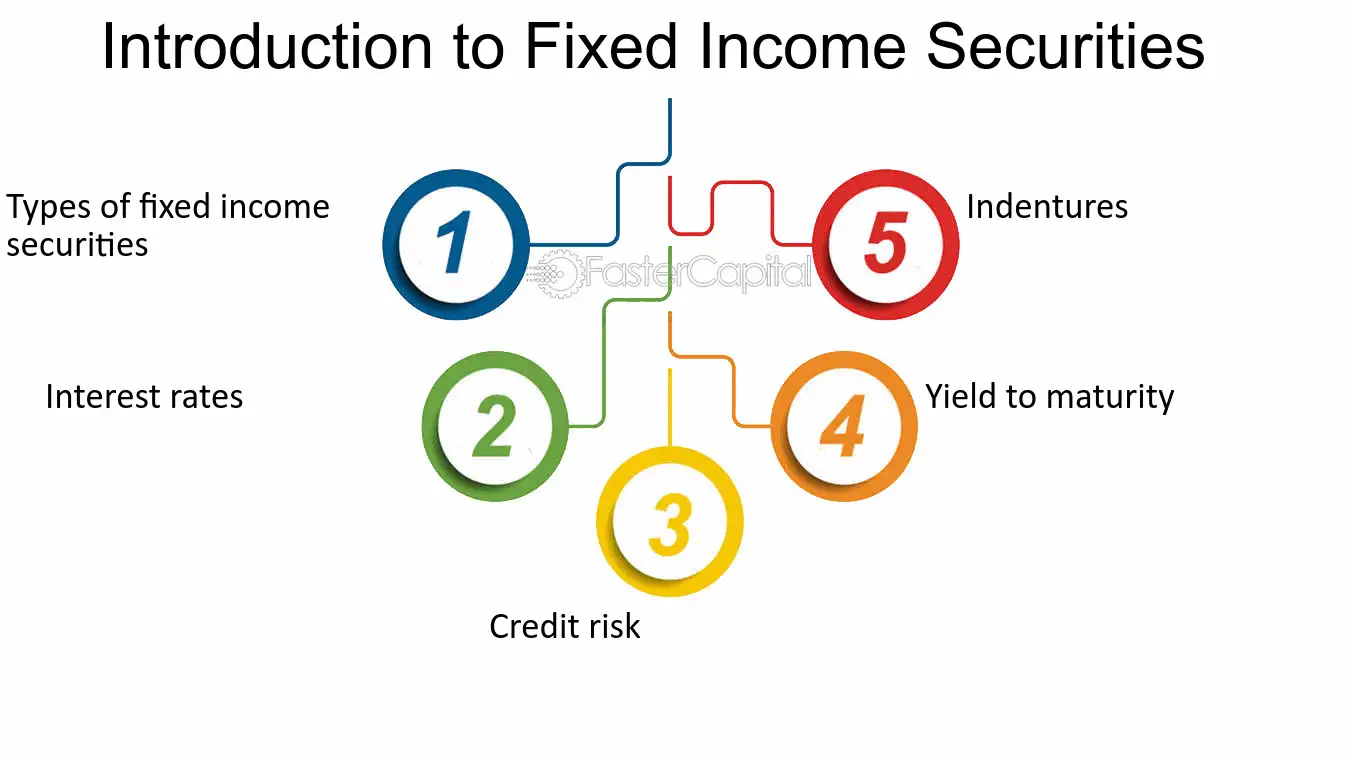

Understanding Fixed Income Securities

Fixed income securities are essentially loans investors make to corporate or government entities. In return, the borrower agrees to pay interest at predetermined intervals and to return the principal amount upon maturity. The stability of these payments is what draws investors to fixed income securities. They provide a buffer against the volatility of the stock market, offering a safer haven during economic downturns.

Types of Income Investments

Government Bonds: Issued by governments, these are considered low-risk because the tax authority of the issuing government backs them. Investors favour them during times of economic uncertainty for their stability and reliable interest payments.

Corporate Bonds: Issued by companies, these commonly offer increased yields than government bonds due to the increased risk of default. Corporate bonds are attractive to investors looking for better returns and are willing to accept a higher level of risk associated with the financial health of the issuing companies.

Municipal Bonds: Issued by states, cities, or local government entities, often offering tax-free interest income. This tax exemption makes municipal bonds appealing to investors in higher tax brackets seeking to reduce their taxable income.

Certificates of Deposit (CDs): Issued by banks with fixed interest rates and terms. CDs are a popular choice for conservative investors due to their FDIC insurance, which protects the principal up to certain limits.

Yield: The Key Indicator

The yield of a fixed income investment indicates the return investors can expect to receive, expressed as a percentage of the principal. Yields vary based on the credit of the issuer, the duration of the investment, and market interest rates. Higher yields generally accompany higher risks. Thus, a bond issued by a corporation with low credit ratings will offer a higher yield than one issued by the government.

How to Assess Fixed Income Yields

Investors should consider several factors when assessing the yields of such investments:

Credit Risk: The risk the issuer may default on its financial obligations. Higher credit risk is usually compensated by a higher yield. Investors need to carefully evaluate the issuer’s creditworthiness and economic stability to mitigate potential losses from defaults.

Interest Rate Risk: The risk that arises from fluctuations in the baseline interest rate. If interest rates rise, the significance of existing bonds with lower interest rates may decrease. Conversely, if interest rates fall, the value of these bonds will generally increase, making them more valuable if sold before maturity.

Inflation Risk: The risk that inflation might erode the purchasing power of future income payments. Fixed income investors must consider the impact of rising prices over time, which can lower the real returns on their investments than expected.

Strategies for Fixed Income Investing

Diversification: By investing in a mix of different types of fixed income securities, investors can manage risk effectively. This might include a combination of government bonds, corporate bonds, and municipal bonds. Such a strategy spreads the risk and potential impact of any security’s performance, increasing overall portfolio stability.

Laddering: This involves purchasing bonds with different maturities. As each bond matures, the principal is reinvested in new bonds with longer maturities at prevailing interest rates, helping to manage interest rate risks. Laddering also provides regular opportunities to adjust the portfolio in response to changing economic conditions.

Duration Management: Investors must balance the duration of their bond investments based on their tolerance and the interest rate environment. Longer-duration bonds are more sensitive to changes in interest rates. Effective duration management can help safeguard investments against market volatility and preserve capital.

Advantages of These Investments

These investments offer several advantages:

Stable Returns: They provide a predictable income stream, which is crucial for budgeting and planning, especially for those in retirement. This consistency allows retirees and other investors to plan their expenses and future investments with a higher degree of certainty. Furthermore, stable returns are less affected by the day-to-day fluctuations of the market, offering peace of mind during economic uncertainties.

Risk Mitigation: They help diversify and reduce overall portfolio risk, serving as a counterbalance to the volatility of equities. By incorporating fixed income investments, investors can smooth out the peaks and troughs of their portfolio’s performance, leading to a more stable investment experience. This strategy is particularly beneficial in times of stock market downturns, where these investments typically perform better.

Capital Preservation: Ideal for those who need to preserve capital while generating income. Such investments are often less prone to large decreases in value, making them a safer option for conserving the initial investment. Additionally, they are an ideal choice for investors approaching retirement who cannot afford to risk their principal sum as they near the withdrawal phase.

Fixed income investments are essential for creating a balanced investment portfolio, offering stability, predictable returns, and risk mitigation. By understanding the different kinds of fixed income securities and how yields affect returns, investors can position themselves better to achieve their financial goals. While they present certain risks and challenges, the benefits of these investments make them invaluable for investors seeking income and safety.